Cost of Vacation Home Insurance in South Carolina

Your vacation home insurance costs will depend on the size, value, and location of your property; whether you rent it out to others when not in use; the amount of time it remains unoccupied throughout the year; and the amount of coverage you wish to purchase. Vacation homes along the coast can be very expensive to insure.

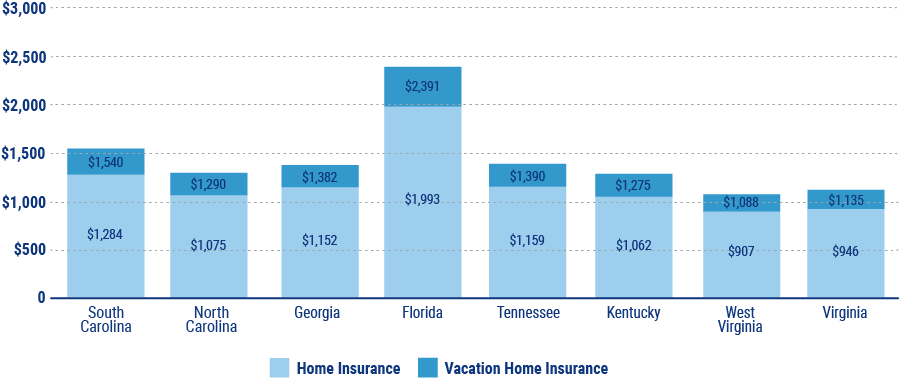

Average Cost of Vacation Home Insurance