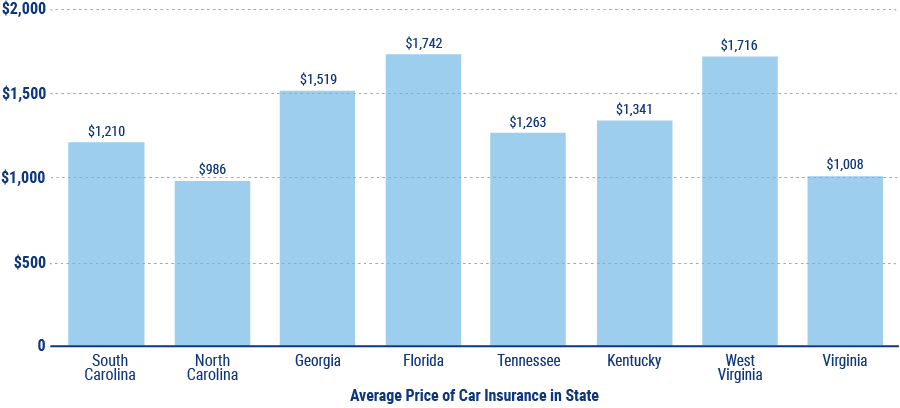

Average Cost of Car Insurance in South Carolina

On average, Americans pay $1,311 a year for car insurance. In South Carolina, the average rate is just $1,210. That doesn’t mean you don’t have room for big savings. Independent agents can help you compare auto insurance quotes from multiple providers so you can find the policy that offers the coverage you need at the best price.

Average Cost of Car Insurance Per Year