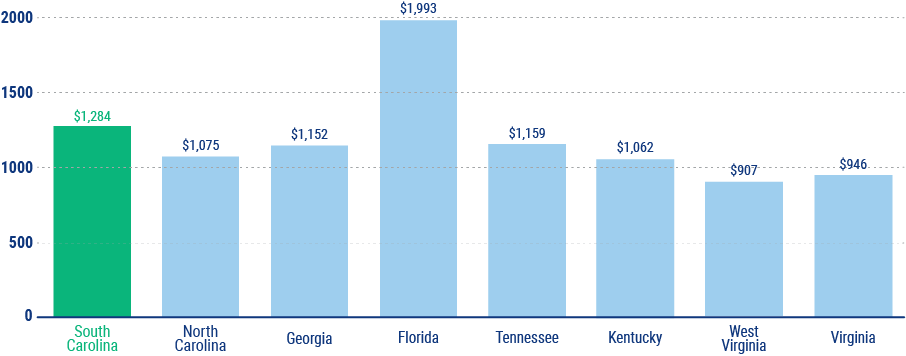

Average Cost of Homeowners Insurance in South Carolina

On average American homeowners pay $1,173 a year for their home insurance policies. The average annual cost in South Carolina is $1,284. While costs may be a bit higher in this coastal state, it is a small price to pay for the peace-of-mind a reliable policy can bring you when disaster strikes.

Average Price for Homeowners Insurance