Average Cost of Business Insurance in South Carolina

Coverage costs can vary greatly from one business to the next. Rates depend on factors such as the amount of property coverage you need, the liability risks your business faces, and the number of people you employ. In South Carolina, risks like hurricane and tornado damage can causes rates to be higher than in less hazardous states.

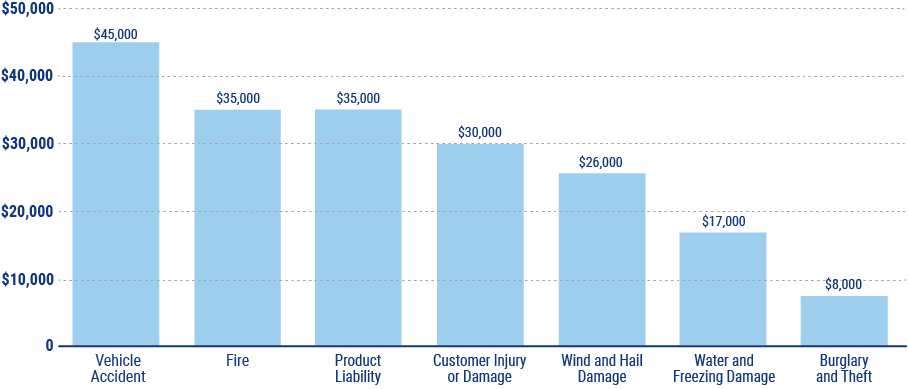

Average Cost for the Top Business Insurance Claims