Whether your horse is a racer or just a fancy showpiece for your farm, it’s a valuable part of your property that deserves its own special protection. Horses can be affected by many threats, from disease to fires and more. Fortunately equine insurance exists to protect horse owners from the devastating loss of their animals.

A South Carolina insurance agent can help you get set up with the right equine insurance policy to best meet your needs. They’ll make sure you get all the coverage necessary to leave you feeling protected. But before we jump that far ahead, here’s a deep dive into this coverage.

What Is Equine Insurance?

Really, equine insurance in South Carolina is a special type of South Carolina life insurance policy designed for horses. Equine insurance policies are assembled to meet the needs of horse breeders, as well as horses that are performers, showers, racers, and more. Coverage focuses on equine mortality reimbursement, so if a covered horse passes away, the owner will receive the death benefit stated in their policy. Since horses are one of the most expensive animals to own and raise, equine insurance can be very handy.

What Does Equine Insurance Cover in South Carolina?

Equine insurance policies focus on the mortality of horses, but also include coverage if your insured horse is stolen. A death benefit will be paid to the owner upon the passing of their insured horse due to a covered peril such as acts of nature (e.g., lightning), fire, disease, etc.

Often equine insurance policies cover the purchase price of the horse in the beginning. The insured value can increase over time if the horse proves to be worth more through awards, breeding income, etc., however. Official records must be provided to the insurance company to demonstrate the increased value of the horse.

What Doesn't Equine Insurance Cover in South Carolina?

Since equine insurance focuses on the mortality of the animal, it does not provide liability protection for the owner. This liability coverage is included, however, in your farm and ranch insurance policy. Equine insurance policies generally exclude coverage for horse mortality caused by intentional neglect or abuse. Certain policies have even more restrictions. Typically, you can choose between full coverage or limited coverage, which comes with more exclusions.

Why You May Consider Equine Insurance in SC - (US Stats)

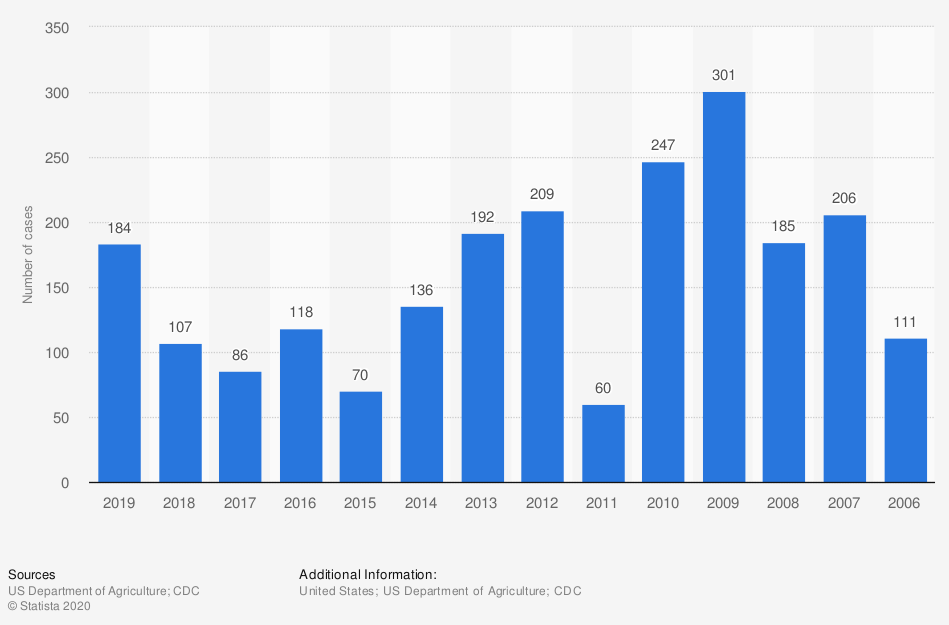

Number of equine cases of Eastern equine encephalitis reported in the US

Eastern equine encephalitis (EEE) is an infection transmitted by mosquitoes. EEE causes neurological problems in horses and can have devastating effects on horse farms. In 2019, there were 184 reported cases of EEE in the US, up quite a bit from the 111 cases reported in 2006. Since disease outbreaks among horses can be fairly common, having the right coverage is critical.

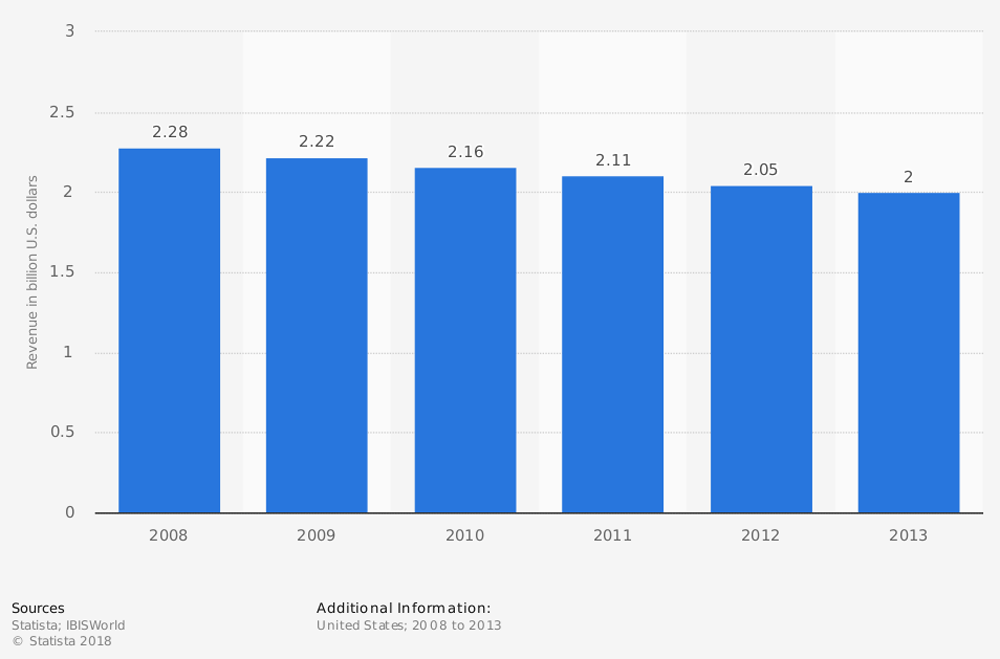

Revenue (in $billions) of horse and other equine production in the United States - (NAICS 11292)

Just how profitable is the equine industry, exactly? Well, in the last recorded year, the US generated a reported $2 billion in revenue from horse and other equine production alone. This amount had fallen a bit from the $2.28 billion generated five years earlier, in 2008.

Do I Need Equine Insurance in South Carolina?

Not legally, no. So you may not choose to purchase coverage if your horse isn’t particularly valuable or is only ever used for leisure riding. But if you’re breeding horses, or have a race horse or a show horse, you're likely to want to look into getting a policy to protect your valuable assets. Horses can cost thousands of dollars to purchase initially, and maintenance of horses also tends to cost thousands of dollars annually.

Even though equine insurance is not mandatory in South Carolina, having coverage does come with important benefits. If you run a serious horse farm or use horses for any sort of professional activities or sports, having the right protection is crucial. A South Carolina independent insurance agent can further help you decide if having an equine insurance policy is the right choice for you, as well as discuss even more benefits of this coverage.

How Many Horses Are Covered Under One Equine Insurance Policy?

As many as you wish. You may choose to insure all of your horses under one policy, or you may just choose to cover the most valuable horses you own. Perhaps you have a couple of prize-winning show horses and one horse that's only used for joy riding. You might choose to insure the show horses and not the leisure-use horse. Your South Carolina independent insurance agent can also help you determine which horses you want to get protection for.

How Much Does Equine Insurance Cost in South Carolina?

The cost of equine insurance varies by each specific policy. A number of factors go into determining premium costs, like:

- The number of horses insured

- The age of the horses insured

- The value of the horses insured

- The profession of the horses insured (e.g., race horse, show horse, etc.)

- The selected death benefit amount

Your South Carolina independent insurance agent can help you find exact quotes for equine insurance in your area, as well as answer any other remaining questions you may have.

Here’s How a South Carolina Independent Insurance Agent Can Help

When it comes to protecting horses and their owners against hazards like theft, fire, disease, and other disasters, no one’s better equipped to help than an independent insurance agent. South Carolina insurance agents search through multiple carriers to find providers who specialize in equine insurance and farm insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Article Reviewed by | Paul Martin

https://www.statista.com/statistics/296419/revenue-horse-and-other-equine-production-in-the-us/

https://www.statista.com/statistics/1024509/cases-of-eee-in-north-america/

iii.org

© 2025, Consumer Agent Portal, LLC. All rights reserved.