Renting your vacation home to renters can be a lucrative venture, but it’s not one that comes without a whole host of risks. Not only do you need to be sure that your property is safe for the renters, but you'll also need to be reimbursed for damage the renters cause to your property. So what happens if renters break the boat at your vacation home? Who’s responsible for this mess, anyway?

Fortunately, a South Carolina independent insurance agent can not only answer this question for you but also help vacation home owners and renters alike to get equipped with the proper coverage. They know just the right protection needed for both sides, and they’ll get you set up with it long before you ever need to file a claim. But first, here’s a closer look at how the right coverages would work in this scenario.

Who’s Responsible If Renters Damage My Boat at My Vacation Home?

Though it was the renter who caused the incident, if they broke your boat while staying at your vacation home, you’d still probably need to file a claim through your personal insurance. In order to protect your boat from incidents by renters and numerous other hazards, you’ll want to work with a South Carolina independent insurance agent to get it set up with the right personal watercraft insurance policy.

How Common Are Boating Incidents?

It might not seem like a likely scenario that renters would break or damage the boat at your vacation home. But boating accidents might happen more often than you think. Check out these stats for boating incidents in the US to further understand the importance of having the proper coverage.

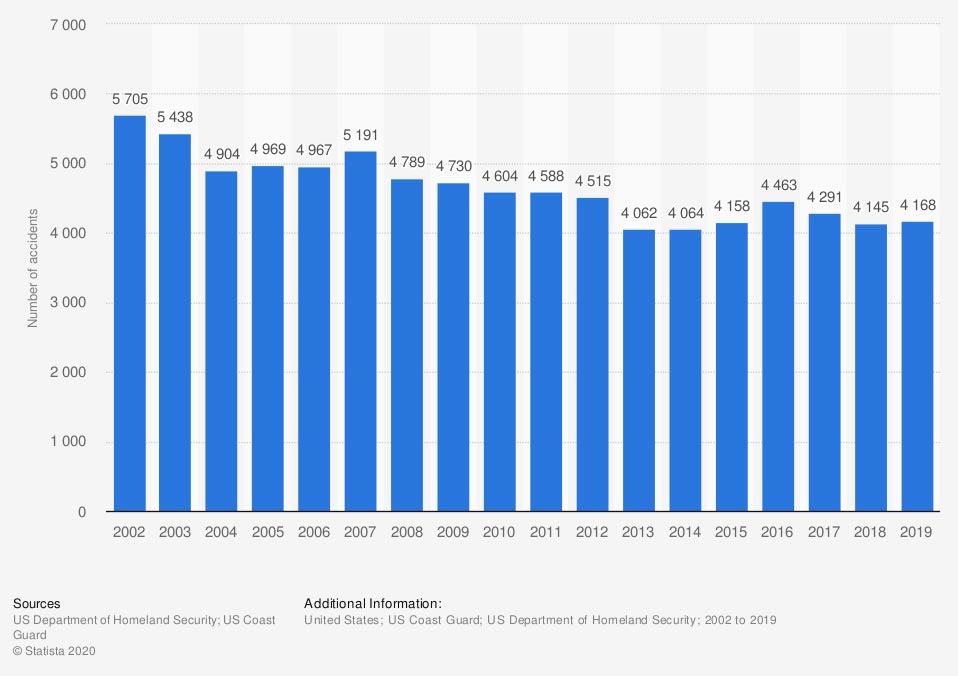

Number of recreational boating accidents in the US from 2002 to 2019

Fortunately, the number of recreational boating accidents has declined over the past couple of decades. However, in 2019 alone there were a total of 4,168 reported recreational boating accidents. That’s an average of more than 11 accidents per day in the US.

Boating accidents are fairly common across the map, and they can be costly without the proper coverage. A South Carolina independent insurance agent can further explain the importance of watercraft insurance for your boat.

Am I Responsible for Covering Any Damage Caused by the Renters?

Unfortunately yes, you’d more than likely need to go through your own insurance to cover the damage. Watercraft insurance protects against physical damage to your own boat and boats belonging to third parties if you’re at fault for an incident. But if renters damaged your boat at your vacation home, your watercraft policy should cover the repairs or replacement value of the vessel, after the cost of depreciation gets factored in.

Do I Need Boat Insurance along with Renters Insurance to Receive Coverage?

For the damage to your boat, yes, you’ll need to make sure it’s equipped with the proper watercraft policy. Watercraft insurance is similar to auto insurance in that after a boating incident, the insurance company reimburses for repairs or replacement of the boat. South Carolina renters insurance and homeowners insurance do not provide coverage for boats. Your South Carolina independent insurance agent can help you find the right boat insurance.

What Does Renters Insurance Cover in South Carolina?

Renters insurance policies in South Carolina operate similarly to anywhere else. This coverage provides important protection for renters and their belongings.

South Carolina renters insurance often covers the following:

- Personal property: This coverage aspect protects your personal belongings like furniture, clothing, electronics, knickknacks, silverware, etc. stored inside the home from various perils like fire or theft.

- Legal issues: This coverage aspect protects against legal fees incurred after being sued by a third party. Liability claims can be filed against you for bodily injury or personal property damage suffered by others while on your rented property.

- Additional living expenses: This coverage aspect reimburses for additional expenses if your home becomes temporarily uninhabitable following a crisis like a fire or natural disaster. Examples include extra gas mileage, hotel stays, laundry services, etc.

- Short-term rentals: Your renters insurance may cover a short-term rental of the property to others as a vacation home. Not all policies include this coverage, however, and some require an extra endorsement or rider to allow you to rent out your property to others, even for a short time. Double-check your policy to be sure.

A South Carolina independent insurance agent can help you review your renters insurance policy to be sure of exactly which coverages it provides.

What Doesn't Renters Insurance Cover in South Carolina?

Renters insurance in South Carolina protects against many common mishaps for renters, but it also comes with various coverage exclusions. While exclusions can vary by policy, a common list for renters insurance is as follows:

- Business-related liability expenses

- Maintenance-related losses

- Tenant neglect of the property

- Insect damage or infestations

- War damage and nuclear fallout

- Flood, earthquake, and mudslide damage

To further protect your property in a coastal state like South Carolina, it’s important to consider adding an extra flood insurance policy. Your South Carolina independent insurance agent can help you find the right coverage.

Here’s How a South Carolina Independent Insurance Agent Would Help

When it comes to protecting vacation home lenders from losing their boat to negligent renters and all other incidents, no one’s better equipped to help than a South Carolina independent insurance agent. Independent insurance agents search through multiple carriers to find providers who specialize in renters and boat insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Article Reviewed by | Paul Martin

Statista

iii.org

irmi.com

© 2025, Consumer Agent Portal, LLC. All rights reserved.