Owners of pig farms have to protect not only the commercial aspects of their business, but also their living inventory. Along with all the equipment and machinery your farm uses, your pigs also need coverage against many different threats, including disease. That’s why it’s critical to get equipped with the right pig farm insurance from the start.

The best way to ensure your pig farm maintains smooth operations for years to come is to consider any and all risks ahead of time. Fortunately a South Carolina insurance agent can help you address these needs and find the right type of pig farm insurance for your unique business. But first, here’s a deep dive into this coverage.

What Is Pig Farm Insurance?

Like other types of farm insurance, pig farm insurance in South Carolina is basically a special type of South Carolina business insurance designed to meet the needs of pig farm owners. Coverage including liability, property damage, worker's compensation and protection for the pigs themselves can be combined into one comprehensive package. Pig farm insurance addresses all the biggest hazards to this type of business, including disease, storm damage, and much more.

How Prevalent Is Pig Farming in the US?

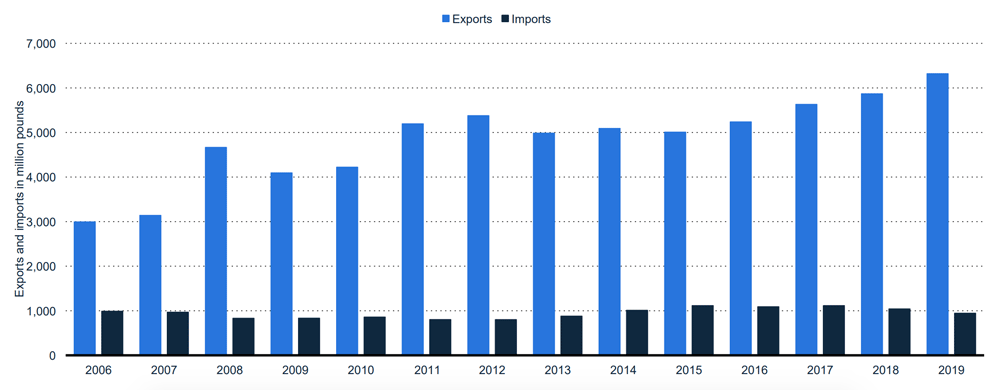

Total US pork imports and exports from 2006 to 2019 (in million pounds)

The amount of pork exports in the US has grown significantly over the years. In 2006, the US exported about three billion pounds of pork. By 2019, the amount of pork exports from the nation more than doubled, exceeding six billion pounds.

How Do You Insure a Pig Farm in South Carolina?

For starters, it’s imperative to work with a South Carolina independent insurance agent who’s experienced in writing coverage for pig farms. Since there are so many areas of pig farms that need their own protection, an independent insurance agent is your best ally when it comes to addressing each concern you may have. They’ll help make sure every aspect of your pig farm gets equipped with the right coverage.

What Does Pig Farm Insurance Cover in South Carolina?

Your pig farm insurance package will be assembled with the help of your independent insurance agent. A special group of coverages designed to best protect your pig farm will be combined into one policy.

The major coverages included in pig farm insurance are:

- Structural protection: Farms of all kinds have tons of structures that need protection, from silos to housing for your pigs. These structures must be covered against perils like storm damage, fire, and more.

- Swine protection: Your pig farm obviously wouldn’t be operational without your drove of living inventory. The most important protection included in your policy is that for a disease outbreak. A single incident could affect all of your pigs, which would be a critical hit to your entire farm.

- Liability protection: Businesses of all kinds are at risk of being sued by third parties for property damage or bodily injuries sustained on the premises. Your pig insurance policy provides this mandatory protection.

- Equipment protection: Your pig farm requires a ton of equipment and machinery to perform daily tasks. These tools need coverage against breakdowns, theft, and more.

Add-on coverage options to a pig farm policy include:

- Commercial auto coverage: If your pig farm has work vehicles that use public roadways for any reason, they need their own special protection against liability claims, vandalism, and more.

- Worker's comp coverage: Though not legally required for farms by the state of South Carolina, if your pig farm has a team of human employees, it’s important to get them protected against potential injuries on the job and more.

- Crop coverage: If your pig farm has any kind of crops, especially any that your business turns a profit from, it’s necessary to look into covering those as well. Crop insurance can be added onto your pig farm policy to provide critical coverage against disasters like freezing, flood damage, and more.

Your South Carolina independent insurance agent will work with you to build a pig farm insurance package that meets all your needs and makes you feel secure in your coverage.

What Are Some Important Benefits of Pig Farm Insurance in South Carolina?

A pig farm insurance policy protects you and your business in a myriad of ways. Just a few of the major benefits include:

- Bankruptcy protection: All it takes is one unforeseen disaster to send any type of business into the red without the proper coverage. Whether it’s a major storm, a fire, a malicious act of vandalism, or a disease outbreak, several hazards could bankrupt your pig farm if it lacks the right protection.

- Lawsuit protection: Whether or not any damage or upset caused by your pig farm is intentional, your business is always at risk of being sued by a third party, and legal fees are expensive. Having liability coverage protects your business from having to pay out of pocket for attorney, court, and settlement fees.

- Physical protection: Without the buildings of the farm itself, you wouldn’t be able to successfully operate a pig farm. All structures on your property need physical coverage against storm damage and more in order to help keep your business in working order.

Your South Carolina independent insurance agent can fill you in on even more important benefits of having the right pig farm insurance.

What Is the Cost of Pig Farm Insurance in South Carolina?

Pig farm insurance policies, like many other forms of insurance, will vary in cost depending on numerous factors. Your specific pig farm insurance policy’s cost will be determined by the following:

- The number of pigs needing protection

- The value and size of any property needing protection

- The condition and value of any equipment and machinery needing protection

- The expense of any additional coverage added to your policy

Pro tip: Having fire protective equipment on your business’s property could save you a ton of money on your pig farm insurance, since fire risk is one of the major factors affecting premium costs.

Your location also influences the cost of your policy. Pig farms right along the Atlantic Coast may pay more for coverage than those located further inland, due to increased risk of storms like hurricanes. Your South Carolina independent insurance agent can help you find exact quotes for coverage in your area.

Here’s How a South Carolina Independent Insurance Agent Can Help

When it comes to protecting pig farms against risks like theft, disease, fire, and all other perils, no one’s better equipped to help than an independent insurance agent. South Carolina independent insurance agents search through multiple carriers to find providers who specialize in pig farm insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Article Reviewed by | Paul Martin

https://www.statista.com/study/44286/hog-and-pig-farming-in-the-us/

irmi.com

iii.org

© 2025, Consumer Agent Portal, LLC. All rights reserved.