Life insurance is the one type of insurance that is designed to help someone else should you die. If you're living in South Carolina with a variety of assets and dependents, a life insurance policy can lighten the financial burden your family might face upon your death.

A South Carolina independent insurance agent can help you understand the difference between term and whole life insurance and which one is the best fit for you. They'll make sure that you get an insurance policy that takes care of those you leave behind.

What Is Life Insurance in South Carolina?

Life insurance is a contract between you and an insurance company where you pay a monthly premium in return for a large lump sum to be paid to a beneficiary of your choice when you pass away. When you purchase life insurance, you'll usually choose between term and whole policies.

- Term life insurance: This plan covers you for a specific period of time, such as 10, 20, or 30 years. If you pass away within the policy time frame, then your beneficiaries will receive the payout. Term life insurance is usually geared toward younger individuals whose financial situations and responsibilities are expected to change over time. You can always extend your policy when your term is up.

- Whole life insurance: This plan covers you until you die. It also comes with a savings account that can accrue cash.

insurance expert Paul Martin is a fan of term life insurance over whole. He explains, "I'm a fan of term insurance because you purchase it during the years when you're most vulnerable, meaning when you're young and have young children. During this time your insurance need is at its peak, but you most likely have don't have a huge budget to pay for it. People will argue that term insurance gets more expensive as you get older. That’s not true."

What Does South Carolina Life Insurance Cover?

Unfortunately, passing away is not cheap. The average funeral costs alone in South Carolina are $7,800, and that doesn't include additional end-of-life necessities that could add thousands of dollars in costs to your death. When you die, all of these costs get passed on to your family. Life insurance is designed to help pay for all of the costs associated with death and other expenses including:

- Monthly bills

- Everyday expenses

- Co-signed debt

- Childcare

- College tuition or education

- End of life expenses

A life insurance policy will cover nearly any death that is the result of an illness, accident or natural causes.

What Is Not Covered by South Carolina Life Insurance?

Life insurance will not cover every death situation, and there are even exceptions to the covered events listed above.

- Inactive or expired policy: Your life insurance policy will not pay out to your beneficiaries if your policy is inactive or expired at the time of your death. This means its crucial to stay up to date on your premiums and always renew your term policy when it's time for renewal.

- Suicide: Many policies will cover suicide, but not if the person dies within a certain time frame of purchasing the life insurance policy. This time frame is usually two years.

- Fraud and criminal activity: A life insurance policy will not cover any deaths related to fraud or criminal activity. If the policyholder willingly participates in a crime or fraudulent activity that results in their death, the policy will not pay out to the beneficiaries.

Do I Need Life Insurance in South Carolina?

Life insurance is never mandatory, but there are still plenty of reasons to purchase it. According to Paul Martin, you need life insurance when your death would result in a loss of income that would negatively impact those that you're survived by. "Even if you don't have a family, you have to ask yourself, if I were to pass away, would someone have to take care of my final expenses?" If the answer is yes, then life insurance is a good idea. Life insurance also allows your dependents to keep and pay for any assets you may have rather than having to sell them if they can't afford to hold onto them. Check out some stats on life insurance ownership in the US below.

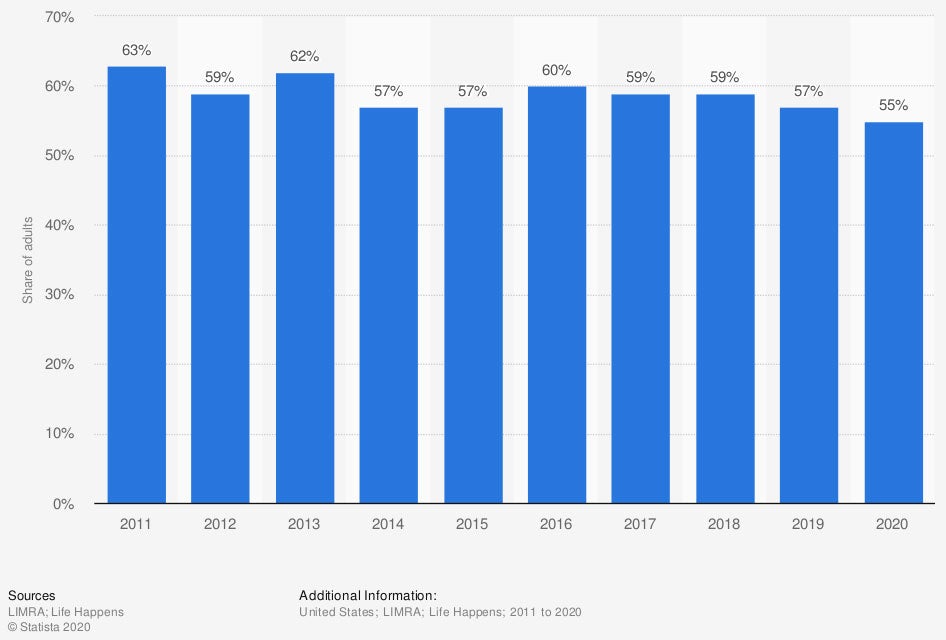

Share of adults who owned life insurance in the United States from 2011 to 2020

In 2020, only 55% of Americans owned life insurance.

How Much Is Life Insurance in South Carolina?

When it comes to life insurance, there is no set price. A variety of factors will come into play, including whether you choose term or whole insurance, term length, age, health, sex, occupation, you and your family's medical history, your habits, and more. Ultimately, the healthier you are the less expensive your life insurance premium will be, because you're less likely to die than someone who is extremely unhealthy and smokes. Policies can range anywhere from $10/month to several hundred dollars a month, but your independent insurance agent can provide you with specific quotes.

What Is South Carolina Business Life Insurance?

If you're a business owner or a key employee, business life insurance can be a major benefit for your employees and business if you were to suddenly pass away. Business life insurance can pay severance to employees if your death results in the closing of your company, expenses for hiring a new owner or key employee, and can even be used by surviving partners to redistribute your share of the business.

Do I Need Life Insurance in South Carolina If I'm Retired?

It's rarely too late to purchase life insurance if your family can benefit from the payout. If you retire without debt or dependents that depend on your income, then you can probably get away with not having life insurance. If you do have some debt that will be passed on to your dependents, but you have a variety of savings and retirement funds that will be given to your dependents when you die, you probably don't need life insurance. Retired or not, the question to ask is if anyone in your life will be at a great financial loss should you pass away. If the answer is yes, then it's smart to keep your life insurance policy.

Another thing to consider is that some life insurance plans do allow you to use the money in your policy for long-term care or to supplement retirement income. This is often called an accelerated death benefit (ADB), which allows you to receive a tax-free advance on your life term policy.

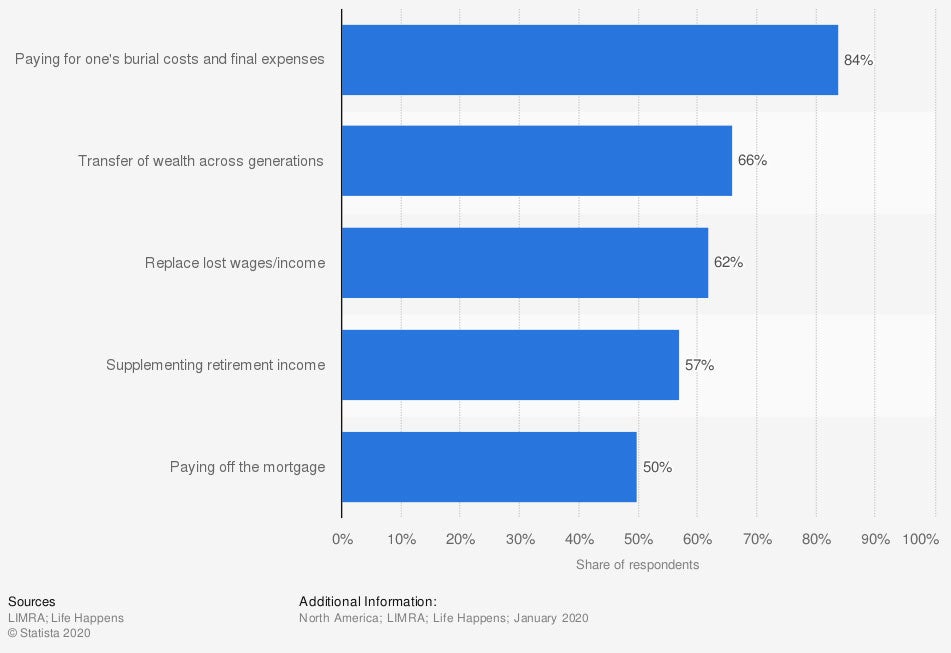

Leading reasons for owning life insurance in the United States in 2020

84% of people said they purchased life insurance to pay for burial cost and final expenses. 57% said their life insurance policy was for supplementing retirement income.

How Much Life Insurance Do I Need in South Carolina?

The easiest way to calculate how much life insurance you need is to sit down and think about your monthly expenses and future predicted expenses should you pass away. Your monthly expenses might include things like the mortgage, car payments, bills, groceries, and childcare expenses. Predicted expenses could be college tuition for your child, a car for your teen, college loans, and other debt. After calculating all of your existing and predicted expenses, you'll want to multiply that number by at least 12 to account for 12 months of expenses, and that's how much life insurance you should purchase.

Why Buy Life Insurance from a South Carolina Independent Insurance Agent?

Purchasing life insurance comes with several options and the best choice for you will vary based on where you are in life financially and by age. A South Carolina independent insurance agent knows the ins and outs of life insurance policies and can shop different options for you. They'll speak with a variety of insurance companies and present you with several different policies and options to choose from.

Article Reviewed by | Paul Martin

https://www.lhlic.com/consumer-resources/south-carolina-insurance/

https://doi.sc.gov/596/Life-Insurance

https://www.statista.com/

© 2025, Consumer Agent Portal, LLC. All rights reserved.