Coastal hurricanes that make landfall in South Carolina can leave quite a mess behind, and having the right insurance on your side before they hit is the key to getting back on track. The more you understand about your coverage, the better it will work for you. Here's a deep dive into how to insure your boat against hurricane damage, and how a South Carolina independent insurance agent can help.

How Common Are South Carolina Hurricanes?

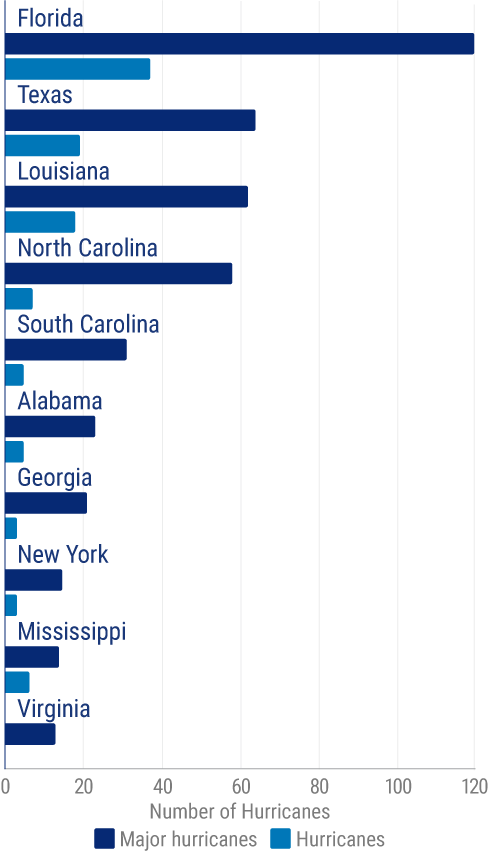

Hurricanes make landfall in South Carolina more frequently than you might expect. In fact, South Carolina is in the top five states nationwide to have been hit by hurricanes over the past century and a half. Check the chart below and see for yourself.

Number of hurricanes that made landfall in the US since 1851, by state

Since 1851, 31 hurricanes made landfall in South Carolina. Of these, five were considered major hurricanes. South Carolina comes in fifth place for hurricanes that have made landfall, just behind North Carolina, which has seen 58 hurricanes make landfall in the same period.

Hurricane Hugo, which hit South Carolina in 1989, caused 13 deaths and 22 indirectly-related deaths. The storm also caused $6.5 billion dollars in damage. Knowing how common, costly, and deadly hurricanes can be in South Carolina can provide extra incentive to get the right boat insurance before it's too late.

How Can Insurance Help Protect My Boat?

Having the right boat insurance can help protect your vessel from the wind and storm damage that comes with a hurricane. Boat insurance policies in South Carolina include:

- Collision coverage: Covers physical damage to your boat after you cause an accident.

- Property damage liability: Covers property damage to other boats, homes, equipment, docks, etc. that you cause with your boat to others.

- Bodily injury liability: Covers bodily injuries to others that you cause with your boat.

Your boat insurance policy may also include coverage to haul your boat out of the water to keep it protected from hurricane damage. Work with your South Carolina independent insurance agent to review your policy for all the ways your vessel is protected against hurricanes.

Can I Extend My Boat's Coverage beyond the Existing Limits?

There are many optional coverages that can be added to your boat insurance. Just a few of the most common are:

- Hull coverage: Covers damage to your boat's hull, equipment, and machinery.

- Emergency assistance on the water: Covers towing and other emergency assistance if you break down on the water.

- Watercraft equipment coverage: Covers your boat's equipment like life vests, etc.

- Comprehensive coverage: Covers your boat against many threats other than collision, including hail or wind damage, theft, and more.

Your South Carolina independent insurance agent can recommend any additional coverages that may help you protect your boat from hurricane damage and much more.

Are There Natural Disasters that Boat Insurance Doesn’t Cover?

The main thing to understand about boat insurance policies is that they're not standard. This means that your policy could look very different from your neighbor's. Furthermore, many exclusions in boat insurance are related to state laws and restrictions for boaters.

In South Carolina, boaters who are 16 or older have no restrictions legally. However, younger folks who wish to operate a boat must either be accompanied by someone who's 18 or older, or they must pass a state-approved safety course in boating. To find out your specific policy's exclusions, ask your South Carolina independent insurance agent to review your coverage with you.

How to File a Boat Insurance Claim after a Hurricane

If your boat's been damaged by a hurricane or anything else, make sure to file a claim with your insurance as soon as you can. The earlier you start the claims process, the sooner you can expect any reimbursement you're entitled to.

Take these steps to file a boat insurance claim after a hurricane or other disaster:

- If necessary, file a police report: If the hurricane caused an accident that involved other people or their property, file a claim with the police right away.

- Photograph the damage: Use your cell phone or camera to document any damage caused to your boat or by your boat.

- Make immediate repairs: Sometimes repairs are required right away after an incident to keep you safe. If this is the case, go ahead and get these repairs made, but be sure to save your receipts for your insurer.

- Get your files ready: Gather your photo or video evidence, your copy of the police report if you filed one, and any receipts for repairs you've already made before you take the next steps.

- Contact your agent: It's time to call your South Carolina independent insurance agent, who can file a claim through your insurance company for you.

- Stay updated: Your South Carolina independent insurance agent can provide you with an estimated timeline for your claims process and keep you updated every step of the way.

Refrain from using your boat after it's been damaged by a hurricane in the best interests of your safety. Try to relax and wait for a response from your insurance company about when repairs can be scheduled, and when you'll receive reimbursement, instead.

How to Prepare Your Boat before a Hurricane

To ultimately save yourself time, effort, and stress, follow these tips to help prep your boat to minimize the damage in the first place:

- Review your coverage: Know whether your boat insurance covers the cost of hauling your boat out of a hurricane's path before a storm warning ever occurs.

- Move your boat to land: Statistically, boats fare much better in hurricanes if they're stored on land vs. left in the water during the storm.

- Use strong mooring: Moor your boat using long lines and only in spaces where waves have the least chance of building up during a storm, such as in a canal.

- Use multiple anchors: Use two or three anchors on your boat, and leave it in a place with as little fetch as possible.

- Update dock lines: Make sure your dock lines are new and in good shape, and ideally made of nylon.

- Remove excess equipment: Anything that could fly off of your boat during a windstorm, or cause your boat to travel further than necessary during a windstorm, like mainsails, should be removed to minimize potential damage.

Stay tuned to your local weather daily to help minimize the threat of hurricane damage to your vessel as much as possible. Also keep updated on your boat insurance's coverage for assurance that your watercraft will have protection in the event of a sudden storm.

Why Choose a South Carolina Independent Insurance Agent?

South Carolina independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

South Carolina independent insurance agents also have access to multiple insurance companies, ultimately finding you the best boat insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

https://www.westmarine.com/WestAdvisor/Hurricane-Preparation

https://www.statista.com/statistics/1269483/number-of-hurricanes-that-made-landfall-in-the-us-state/

https://www.aoml.noaa.gov/hrd-faq/#landfalls-by-state

https://www.foxcarolina.com/news/remembering-hugo-30-years-later/article_de939bee-ddb2-11e9-a821-775e7cc2f16d.html

https://www.iii.org/press-release/iii-know-your-boats-insurance-coverage-from-stem-to-stern-051619

© 2025, Consumer Agent Portal, LLC. All rights reserved.