Severe weather events like hail can happen often in South Carolina, and knowing how your car insurance works for you is critical in case of an accident. So what happens if hail causes an accident? Who's responsible and who pays for the damage?

While a South Carolina independent insurance agent can help you get protected by the right car insurance, we can start by helping to answer this question. Here's a breakdown of who'd be responsible in this case.

How Common Is Hail in South Carolina?

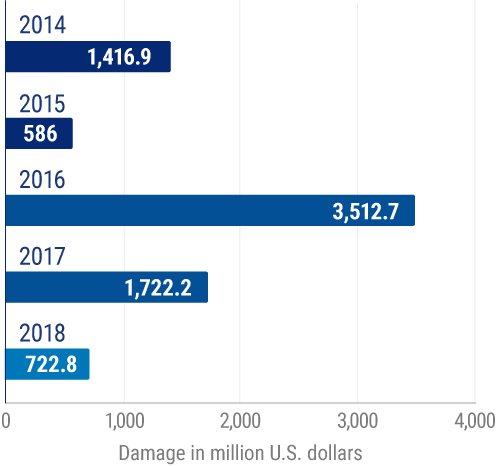

Not only does it hail often in South Carolina, but across the country as a whole. The amount of property damage caused by hail each year might be shocking. Check out the graph below to see for yourself.

Property damage from hail in the US

Hail damage costs the US millions or even more, each year. At the beginning of the observed period, property damage by hail amounted to $1.4 billion. Four years later, this number had decreased a bit, to $722.8 million. But hail damage consistently costs the nation hundreds of millions annually.

Without the right type of coverage, you could have to pay hefty costs due to hail-related property damage out of your own pocket. This is true even in the case of car accidents.

Who’s Responsible If Hail Causes a Car Accident?

According to insurance expert Paul Martin, the "fault" can technically lie with Mother Nature, and you would just go ahead and file a collision claim through your car insurance. It would really depend on the specifics of the accident, but it is possible that there could be a shared fault between both drivers, of 60% and 40%, for example.

South Carolina specifically is considered a "fault" state, meaning that the driver responsible for the accident is the one who pays for the damage and injuries. However, in the case of hail causing an accident, there may be no determined fault, and each driver would file a claim through their own car insurance.

What If One of the Drivers Was Uninsured?

If the at-fault driver didn't have their own car insurance, you could still get reimbursed by your own uninsured motorist coverage. This coverage is mandatory for all drivers in South Carolina, in amounts of at least $25,000 per person, or $50,000 per accident. So if you were properly insured and they weren't, you could still receive coverage for the accident.

Uninsured motorist coverage would also protect you from hit-and-run accidents. So if you got hit by another driver who then immediately fled the scene, your coverage could help pay for repairs to your vehicle and your injuries. Work with a South Carolina independent insurance agent to ensure that you're equipped with all the types of car insurance you need to be protected in case of any weird scenarios on the road.

How Can Car Insurance Help Protect Me From Hail?

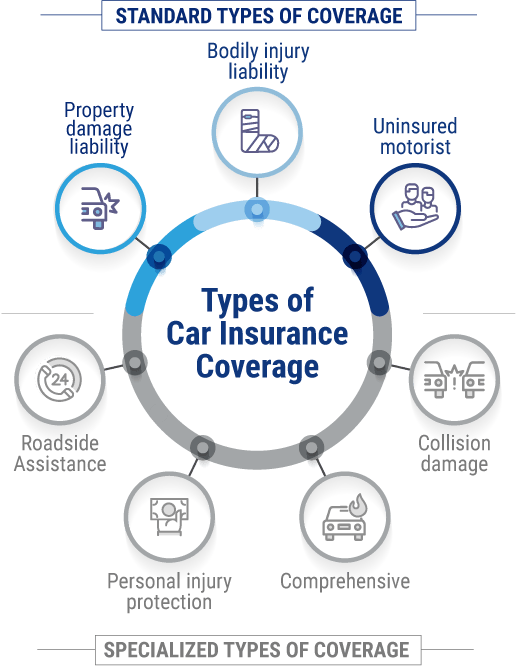

Standard car insurance policies can protect you from hail in several ways. The core coverages include:

- Property damage liability: This coverage would protect you in case a hailstorm caused you to inflict property damage on someone else with your vehicle.

- Bodily injury liability: This coverage would protect you in case a hailstorm caused you to injure others with your vehicle.

- Uninsured motorist: This coverage would protect you against getting into an accident with a driver who was uninsured or underinsured during a hailstorm.

If there wasn't an accident, but just physical damage to your car caused by hail, you'd be covered if you had comprehensive coverage. Comprehensive coverage protects your vehicle from many threats like hail or flood damage, windshield breakage, collisions with large animals, and theft.

If your car is declared totaled from the hail damage, many insurance companies will provide the vehicle's actual cash value as reimbursement. The insurer considers your car's current value, which factors in depreciation over time, as well as the shape your car was in before the damage and how many miles were on it. Your South Carolina independent insurance agent can help you review your policy for more details.

Can I Extend My Car Insurance Coverage beyond the Existing Limits?

There are many types of car insurance that can be added onto a standard policy to provide you with a fuller picture of protection. Some of the most common include:

- Collision damage: This covers the cost to repair or replace your vehicle if it gets damaged or totaled in a collision, regardless of fault.

- Comprehensive: This covers the cost to repair or replace your vehicle if it gets damaged or totaled by a non-collision event such as a hailstorm or theft.

- Personal injury protection: This covers injuries to you or your passengers after an accident that you're at fault for.

- Roadside assistance: This covers the cost of towing and other roadside assistance services if you break down on the road.

A South Carolina independent insurance agent can help you get covered by all the types of car insurance you need to feel safe and secure in your vehicle.

What Doesn't Car Insurance Cover?

Car insurance in South Carolina comes with many important protections, but it also has its own set of exclusions, like:

- Intentional acts: If you purposefully damage someone else's property or injure them, your car insurance won't cover you.

- Driving while impaired: This depends highly on your specific insurance company, but many insurers argue that driving while impaired is an intentional act, and won't cover you for damage or injury you caused under the influence.

- Maintenance costs: Routine maintenance costs are considered the driver's responsibility, so car insurance won't cover them.

Natural disaster damage to your vehicle, whether by hail, lightning, or flood, would be covered by comprehensive coverage. If you're unsure if you have enough coverage for certain events, check with your South Carolina independent insurance agent.

What If I Have an Umbrella Policy, Will That Kick in and Help?

If you're found to be at fault for a car accident and the damage or injuries to the other parties exceeds your insurance's limits, you can get the extra coverage you need from an umbrella policy. Umbrella insurance stacks on top of your car insurance to extend its liability limits, often in increments of $1 million.

Say you were found at fault for the accident during the hailstorm and you couldn't afford to cover all the damage or injuries once your car insurance limits were exhausted. An umbrella insurance policy could kick in to cover the remainder you were responsible for.

Why Choose a South Carolina Independent Insurance Agent?

South Carolina independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

South Carolina independent insurance agents also have access to multiple insurance companies, ultimately finding you the best car insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

https://www.statista.com/statistics/1015618/property-hail-damage-usa/

https://www.iii.org/fact-statistic/facts-statistics-hail

https://www.clorelaw.com/insights/is-south-carolina-a-no-fault-state#:~:text=The%20state%20of%20South%20Carolina,paying%20attention%20to%20the%20road.

https://www.farrin.com/sc/car-accident-lawyers/insurance/uninsured-underinsured/#:~:text=In%20South%20Carolina%2C%20all%20drivers,is%20the%20minimum%20level%20required.

https://time.com/nextadvisor/insurance/car/does-car-insurance-cover-hail-damage/

https://www.caranddriver.com/car-insurance/a36148539/acv-car-insurance/

https://www.nolo.com/legal-encyclopedia/dui-related-accidents-and-car-insurance.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.