A finished basement can add value to your home but also increase your insurance rates. The more livable space you have, the more space you need to insure. A basement can also increase your chances of flooding, and in South Carolina, 3% of properties are at risk of flooding over the next 30 years.

To learn exactly how a basement will impact your insurance rates, you can work with a South Carolina independent insurance agent. Agents can help you price home insurance quotes and find an affordable policy.

Why Is Home Insurance so Expensive in High Flood Risk Homes?

While the algorithm that insurance carriers use to calculate premiums is complicated, insurance itself can be broken down very simply. The more risks you present, the more expensive the insurance.

In South Carolina, if you live in a flood zone, you're more likely to eventually have to file a flood claim than those that reside elsewhere. When calculating premiums, the insurance company looks at how much they'd possibly have to pay if you were to file a claim and create premiums that reflect that number.

Common factors that impact home insurance rates include:

- Age of home

- Foundation of home

- Local crime rates

- Value of your home

- Home safety features

- Your deductible

- Amount of coverage you need

If your home is at risk of flooding, you could be facing higher premium costs and the need to purchase flood insurance. Flooding from natural waters is excluded from home insurance, so buying a separate plan is an added cost to keep in mind.

How Do Different Basements Affect Flood Risk and Insurance Rates?

Basements can exist in various ways, and the type of basement you have can impact your insurance rates. These are the four most common types of basements and how your rates may be affected.

- Walk-out basement: A walk-out basement has an entryway outside the home. As a result, not all sides of the basement are below grade, making the basement's risk of flooding lower. Since the risk of flooding decreases, there may not be a major impact on insurance rates.

- Full basement: A full basement is located below grade and has no entryway other than through the home. Full basements run the risk of flooding from windows or the ground, which ultimately causes insurance rates to be higher. Floodwaters that enter at or below the ground surface of a home are not covered by insurance. Groundwater flooding as a result of a rainstorm would be covered by flood insurance if it affected other properties as well.

- Finished basement: A finished basement is a space that's been made livable and can be considered added value to the home. Finished basements can cause a major increase in insurance rates, because most things in a finished basement are not covered by flood insurance. Things like drywall, carpet, window treatments, furniture, and other added personal items are not covered under home insurance or flood insurance. You would need to purchase a private flood insurance policy for coverage, which could get expensive.

- Unfinished basement: An unfinished basement can sit below grade or not, but does not tend to impact insurance rates too much. With minimal items to be destroyed, there's typically not much that needs to be covered in an unfinished basement. Flood insurance includes coverage for things like furnaces, circuit breakers, washers, dryers, and freezers. Unfinished basements rarely have contents beyond this.

Why Does South Carolina See So Many Floods?

South Carolina has low-lying topography and a humid subtropical climate, making it a target for a variety of flood hazards. The state is at risk of flooding from severe thunderstorms, hurricanes, seasonal rains, and other conditions. South Carolina's coast is also a target for coastal flooding.

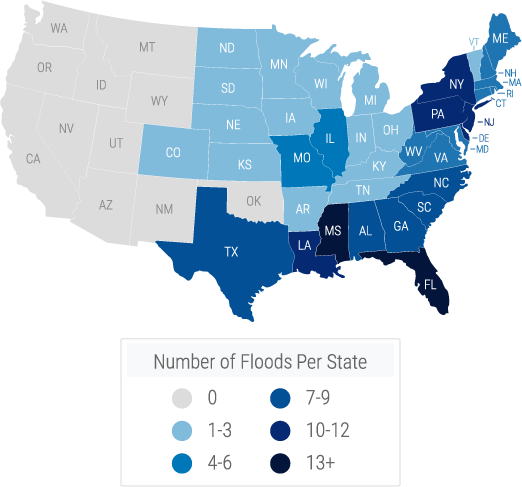

South Carolina is one of the top 10 states for flooding in the US

The state has had several historic flooding events, but a good example of the type of storm that can hit South Carolina is from 1999, when three tropical storms resulted in 24 inches of rain in a single county. During this time, the Waccamaw River and its tributaries caused severe flooding throughout northeastern South Carolina.

US Flood Risk Map

Do I Need Flood Insurance in South Carolina on Top of Home Insurance?

Some homeowners in South Carolina may be required to purchase flood insurance for their homes. If you live in a high-risk flood zone, a mortgage lender may require that you have a policy in place.

Whether you live in a low-risk or high-risk flood zone, discussing flood insurance with your South Carolina independent insurance agent is a good idea. Hundreds of thousands of properties in the state are at risk of flooding over the next 30 years. Without the proper coverage, any flood damage to your home or personal property would be your financial responsibility.

What Does Flood Insurance Cover?

There are two ways to purchase flood insurance, through a private carrier or through the National Flood Insurance Program (NFIP). In South Carolina, more than 200,000 homeowners have coverage through the NFIP. This coverage includes:

- Damage to/loss of your home: This includes the home's foundation, electrical systems, indoor plumbing, built-in appliances, installed flooring, and detached structures.

- Damage to/loss of your stuff: This includes built-in furniture, freestanding furniture, personal appliances, valuable clothing, artwork, and similar possessions.

As we mentioned earlier, flood insurance does have some exclusions when it comes to basements. If your home has a finished basement, you may want to work with your South Carolina independent insurance agent to discuss adding personal contents coverage through a private flood policy.

How Much Does Flood Insurance Cost in South Carolina?

Flood insurance costs vary depending on your risk factor, location, and whether you purchase through the NFIP or a private company. Here's how flood insurance costs may look for different individuals in South Carolina.

- NFIP in low-risk flood zones: $450-$700 a year

- NFIP in high-risk flood zones: Up to $3,351 a year

- Private flood insurance: Between $450-$3,300 a year

In the past 10 years, the average NFIP claim payout for South Carolina residents has been $27,100. There are currently more than 1.7 million properties in the state that are not covered by the NFIP.

How Can an Independent Insurance Agent Help?

You have several options when it comes to purchasing flood insurance, and a South Carolina independent insurance agent can help you determine which policy is best for you. Agents are located across the state and have experience working with the NFIP and private insurance companies.

Whether you're looking to purchase a home or evaluate your existing coverage, an agent will chat with you, free of charge, to help you get set up with the best home and flood insurance for your South Carolina home.

Article Reviewed by | Paul Martin

https://floodfactor.com/state/southcarolina/45_fsid

https://www.betterflood.com/flood-insurance-south-carolina_charleston-sc-flood-zone-map_south-carolina-flooding/

https://www.scemd.org/prepare/types-of-disasters/floods/

https://www.floodinsuranceguru.com/blog/4-types-of-basements-and-how-they-can-impact-your-flood-insurance-rates

https://www.fema.gov/sites/default/files/documents/fema_south-carolina-state-profile_03-2021.pdf