After a young driver gets their first set of wheels, the next step is to make sure they’re equipped with the proper protection before they ever hit the road. From accidents to car theft, drivers of any age face a number of threats on a daily basis. The right South Carolina car insurance policy helps guard young drivers against all kinds of hazards.

Fortunately a South Carolina insurance agent can help young drivers get set up with all the coverage they need to feel secure behind the wheel. But before we get too far ahead of ourselves, here’s a closer look at this important coverage.

What Does Car Insurance Cover for Young Drivers in South Carolina?

The answer to that depends on the specific type of South Carolina car insurance you select. While some coverages are mandatory by state law, other forms are optional. That being said, young drivers in South Carolina really should be equipped with at least the following types of car insurance coverage:

- Bodily injury liability: Liability coverage cannot be compromised. It’s recommended that young drivers get as much as they can afford, with the highest limits possible. Bodily injury liability covers medical and emergency treatment of injuries to the other driver and their passengers after an accident.

- Property damage liability: This type of liability coverage is also legally required, and reimburses for physical damage to the driver’s vehicle after an accident, as well as repairs to another driver’s vehicle. Damage to other property like fences is also covered.

- Uninsured motorist coverage: Also legally required in South Carolina, this coverage protects drivers who are hit by another driver that does not carry adequate or any auto insurance themselves.

- Collision coverage: Though not legally required, collision insurance is really important to carry if you want the option to recoup any losses if your vehicle gets wrecked in an accident.

- Comprehensive coverage: Another optional coverage, comprehensive (otherwise known as “other than collision”) coverage protects against many other threats to young drivers, such as vehicle theft.

A South Carolina independent insurance agent can further discuss which forms of auto insurance coverage make the most sense for a young driver.

Car Stats for Young Drivers in South Carolina to Consider

When teaching young drivers about the importance of having car insurance, reviewing stats and trends can be extremely helpful. Check out a couple of alarming reports of trends for two of the most common hazards young drivers need coverage for.

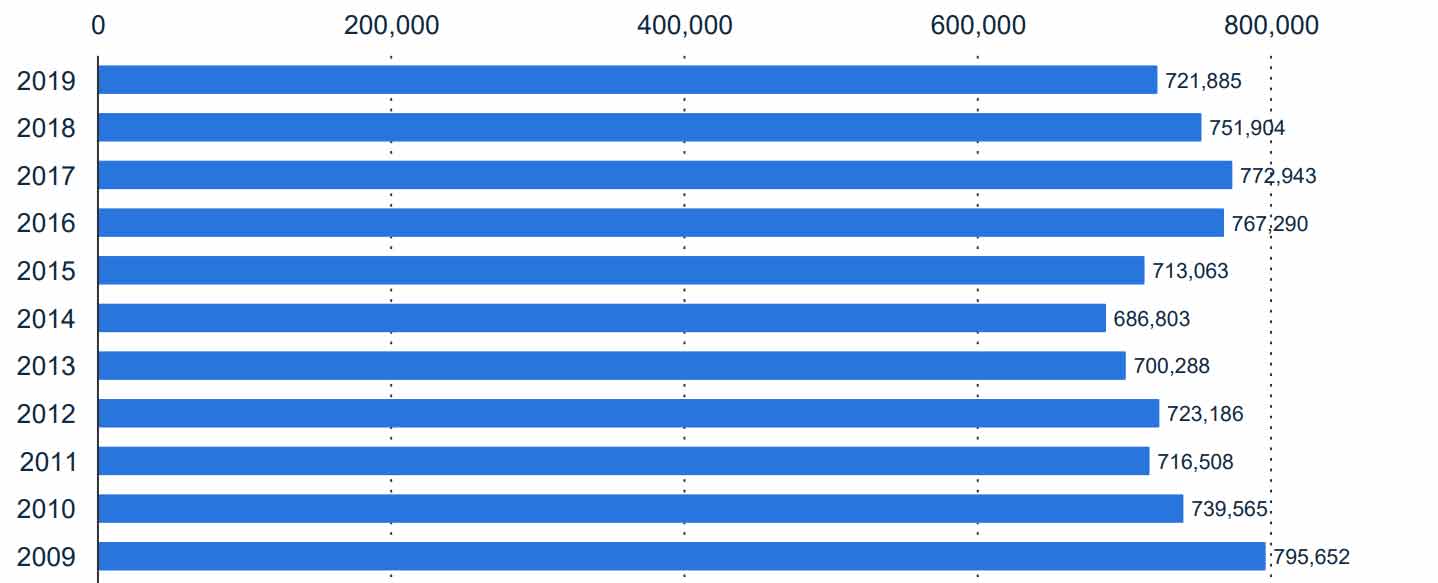

Number of reported motor vehicle theft cases in the United States from 2009 to 2019

In 2019, there were 721,885 reported cases of vehicle theft in the US. This number was down quite a bit from the year 2009, in which 795,652 cases of vehicle theft were reported. However, the decrease is not nearly significant enough to offset the real need for theft protection among all drivers in the US.

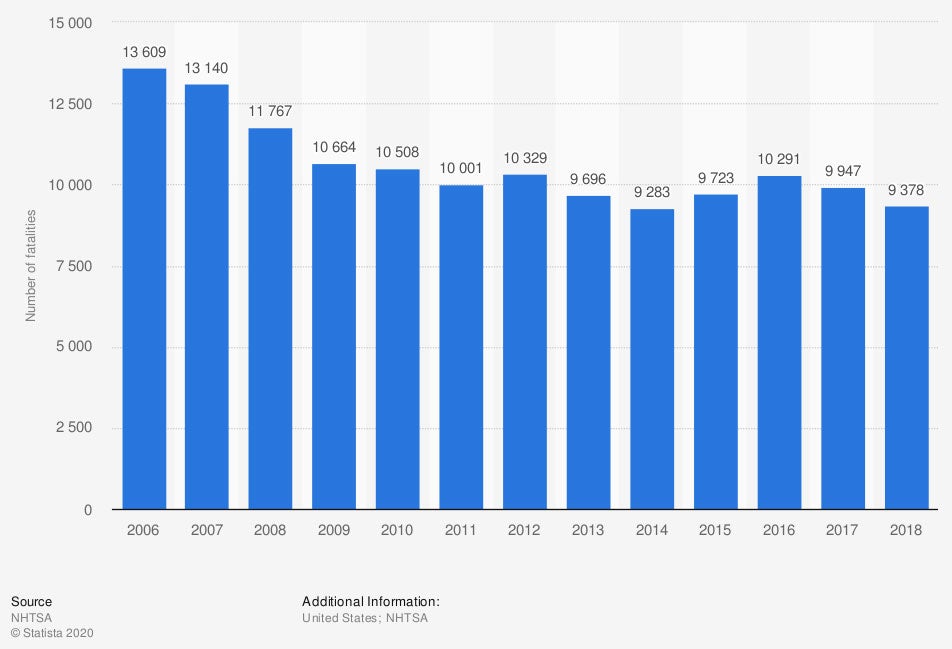

Number of speeding-related fatalities in the US from 2006 to 2018

Of course, one of the biggest concerns pertinent to young drivers is speeding, particularly when it leads to fatalities. In 2018, there were 9,378 fatalities reported due to speeding in the US. The number of fatalities had decreased a bit from the 13,609 reported in 2006, but the trend of around 10,000 deaths due to speeding-related incidents has remained fairly consistent over the past several years.

What Is the Cost Difference for Young Drivers in South Carolina?

Drivers under the age of 25 account for the vast majority of all traffic incidents, and therefore have the premium rates that go along with it. Adding a young driver to an existing car insurance policy can skyrocket the premium rates by as much as 40% to 80%. Fortunately these rates can be lowered over time as the driver ages, and also by discounts for things such as being a good student and living on campus.

Why Do Car Insurance Companies in South Carolina Charge More for Young Drivers?

The idea that car insurance companies across the map charge a lot more to insure younger drivers isn’t a rumor or myth, it’s a solid fact. This happens for many reasons, including:

- Inexperience: Simply put, drivers with less experience are more prone to making risky and costly mistakes and ending up in accidents.

- No prior record: Without a good driving history, insurance companies have no reason to trust the driving habits of the insured driver. Over time, a clean record can help to lower car insurance costs significantly.

- Lack of impulse control: Younger drivers, especially those in their teens, have not developed the same kind of impulse control as more mature drivers. This may cause them to run red lights, and engage in road racing and other dangerous behaviors.

- Distracted driving habits: Younger drivers are much more likely to engage in distracted driving habits such as texting, conversing with friends, or blasting loud music while behind the wheel.

Your South Carolina independent insurance agent can further explain why younger drivers pay more for car insurance, as well as help you find average costs in your area.

How Much Does Car Insurance Cost for Young Drivers in South Carolina?

Though it’s well known that car insurance costs a lot more for younger drivers in South Carolina, unfortunately it’s not as easy to determine the specific rates, since they’re based on several factors. Even young drivers’ policies will be priced based on many different things, like:

- The kind of car they drive: Typically, more expensive cars cost more to insure.

- Their credit history: Younger drivers may not have as much credit history as older drivers, but their habits will still be taken into account when determining the cost of their premiums. Credit scores have been shown to be linked to driving behaviors in numerous studies.

- Their specific age: As a young driver ages, their insurance premiums can start to fall, especially after age 25.

- Their annual mileage: Younger drivers might pay less for auto insurance if they drive below a specified number of miles annually. Less time on the road means less chance of accidents and other costly claims.

- Their location: Younger drivers who live in larger cities might pay even more for their coverage due to increased risk of crimes like theft, etc.

A South Carolina independent insurance agent can help you find quotes for car insurance in your area.

Here’s How a South Carolina Independent Insurance Agent Can Help

When it comes to protecting young drivers against traffic accidents, theft, and all other perils, no one’s better equipped to help than an independent insurance agent. South Carolina insurance agents search through multiple carriers to find providers who specialize in auto insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Article Reviewed by | Paul Martin

https://www.statista.com/study/32369/car-insurance-in-the-us-statista-dossier/

https://www.statista.com/statistics/720326/speeding-related-fatalities-in-the-us/

iii.org

© 2025, Consumer Agent Portal, LLC. All rights reserved.